Zurück

How to Maximize Depreciation Through Structure Value

Written by:

Jeremy Werden

July 17, 2025

⚡️

Entdecken Sie die Airbnb- und Langzeitvermietungs-Rentabilität jeder Immobilie

Diese Immobilie kaufen und auf Airbnb anbieten.

The hype from the comeback of 100% bonus depreciation via the passing of the Big, Beautiful Bill is real. There’s no denying the huge opportunity here for those looking to purchase new rental properties.

This begs the question, how can you get the most value out of your depreciation deductions? Well, one of the ways is looking at structure value. It’s an often overlooked aspect of depreciation, yet can have a large impact on your total depreciation deductions. So, let’s take a look at how you can maximize depreciation using structure value.

Understanding Land Value vs. Structure Value

One of the common misconceptions investors make is looking at the total value of the property, assuming everything can be depreciated. In terms of depreciation, there are two main components that go into the purchase price: The land valueand thestructure value.

Land value refers to the worth of the raw land itself, excluding any buildings, structures, or improvements built on it. This represents the financial worth of the bare plot of ground based on factors like location, zoning, size, and development potential.

Structure value (also called building value) represents the worth of the physical structures constructed on the land - houses, commercial buildings, garages, or other improvements. This includes the cost of materials, labor, and construction that went into creating the built environment.

Probably the most important difference between the two is that you cannot claim depreciation on land value. It’s one of the most fundamental rules from the IRS since land doesn’t necessarily wear out or decay.

Structure value is where you can get some depreciation deductions from. There are a variety of depreciation strategies, including specific components where you can claim 100% bonus depreciation from year one, depending on what you’re claiming for.

How Structure Depreciation Works

The IRS allows you to depreciate the building portion of your property over specific timeframes:

- Residential property: 27.5 years

- Commercial property: 39 years

Most long-term rentals can typically be depreciated over the course of 27.5 years, however Airbnbs usually fall under the 39-year nonresidential treatment because of their transient treatment and hotel-like operations.

The key point is only the structure (and improvements like roofing, HVAC, or appliances) is depreciable. The land itself is not, because it doesn’t wear out. That’s why separating land and structure value accurately is crucial for maximizing depreciation.

For example, if you buy a residential property for $500,000 where the structure value is deemed at 70%. This means that the structure is appraised for $350,000 and the land is $150,000, you can deduct about $8,974 per year ($350,000 ÷ 39) as a non-cash expense.

Now, there’s another property at $500,000 purchase price but the structure value is at a higher 80%. This results in an $400,000 structure value, with a $100,000 land value. This results in a significantly higher $10,256 in yearly deductions ($400,000 ÷ 39) instead of the aforementioned $8,974, despite having the same $500,000 purchase price.

This highlights how crucial it is to correctly identify the structure value. A more expensive property doesn’t always mean more depreciation, it all depends on how much of that value is actually tied to the structure, not the land.

How to Separate Land Value From Structure Value

There are three main ways to properly get the structure ratio for you property. These are the most common methods that’s accepted by the IRS.

Use the County Property Tax Assessor’s Ratio

The most common and often cheapest method is using the county property tax assessor’s ratio. Most counties usually assess properties every 1 to 3 years, while others only re-assess when there’s a change in ownership or major improvements. While this is primarily done for property tax purposes, these records are publicly available and can be used as a basis for the structure value.

Since the records are publicly available, it’s the cheapest option for investors to get an IRS-accepted structure value. However, since it can take up to 3 years to get new appraisals, the readily available data can be outdated and don’t reflect current market values.

Get an Appraisal

If the tax ratio provided by the local government is outdated or doesn’t reflect the current market value, another route investors can take is hiring a professional appraiser. A professional real estate appraiser can provide a more precise market-based allocation of land vs. structure value. This method is highly defensible in an audit as long as proper documentation is available to support it. Hiring an IRS certified appraiser will also greatly help in the chances of IRS acceptance

It's more accurate and representative of the current market value of the property, and comes with great supporting documents provided by the professional. It typically costs anywhere from a couple hundred dollars to the low thousands, depending on your property type and size. While it lacks detailed component breakdowns, it still provides a more updated structure value ratio, reflective of the actual market.

Doing a Cost Segregation Study

Finally, doing a cost segregation study is by far the best way to maximize your deductions. A cost segregation study can break down the entire property into specific components like, structure, land improvements, etc, and provide detailed allocations. From there, investors can not only claim the standard structure value depreciation, but can also claim accelerated depreciation using 5, 7, or 15-year schedules, depending on the professional’s audit. Not to mention being able to claim 100% bonus depreciation, due to the recent passing of the Big, Beautiful Bill, from year 1.

A cost segregation study also offers strong IRS audit protection, when done by the right professionals. However, it’s definitely more expensive overall often starting at around $1500 to $2500 or more. Get started with DIY Cost Seg and save $50 using code BNBCALC.

What Qualifies as Depreciable Structure Value

A lot of items and components can actually qualify for depreciation. This is why it’s extremely important to perform a professional cost segregation study, if you’re looking to maximize your dedcutions. Here’s a few of the most common parts that depreciate:

Building Structure

- Foundation and structural framework

- Walls, roofing, and flooring systems

- Windows and doors

- Exterior finishes and siding

Mechanical Systems

- HVAC equipment and ductwork

- Electrical wiring and panels

- Plumbing systems and fixtures

- Built-in appliances

Interior Improvements

- Flooring (carpet, hardwood, tile)

- Kitchen and bathroom fixtures

- Built-in cabinets and countertops

- Interior finishes and paint

Exterior Improvements

- Driveways and walkways

- Fencing and gates

- Swimming pools and decks

- Landscaping systems (irrigation, lighting)

Utility Infrastructure

- Septic systems and wells

- Security and communication systems

- Backup generators

- Underground utilities

Cost Segregation Studies and 100% Bonus Depreciation

One of the most effective strategies for front-loading depreciation is cost segregation. Cost segregation is a study done by tax professionals or engineers that allows you to break down the structure of your property into its individual components, many of which can be depreciated faster than the standard 39 years for Airbnbs.

If you think about it, this makes a lot of sense. While the house structure itself can definitely last 39 years, the items, renovations, and other components generally don’t.

The tax professional breaks down each item into a detailed list that generally fits into one of these three components:

- Personal property (appliances, flooring, window treatments,carpet, lighting fixtures, etc)

- Land improvements (fences, landscaping, driveways,etc)

- Structural components (walls, roof, foundation, etc)

Each of these categories also depreciates at different rates:

- Personal property: 5, 7, or 15 years

- Land improvements: 15 years

- Structure (building): 27.5 years for residential or 39 years for commercial

Essentially, instead of depreciating the structure value as one big lump sump over the span of 39 years, you’re able to depreciate clusters of components in shorter time-spans outside of the main structure itself.

With the 100% bonus depreciation now back, you can claim accelerated depreciation for all qualifying assets immediately instead of over the 5, 7 or 15 year spans. This results in huge deductions right out of the gate and can help jumpstart your business.

Without a cost segregation study, it’s impossible to determine the value of those shorter-life components and there’s no telling which can qualify for bonus depreciation. Investors can only depreciate the entire structure over 27.5 or 39 years and will miss out on upfront bonus depreciation benefits.

Example Calculation

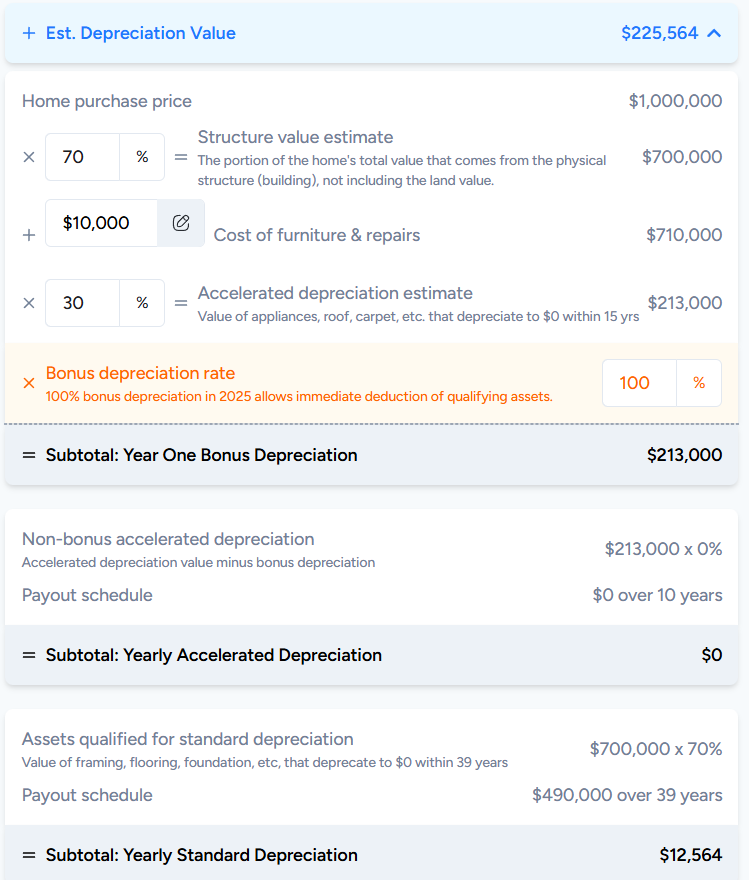

Let’s say a property you’ve purchased costs $1,000,000. You also purchased additional furniture and had to do some repairs amounting to $10,000. From that original $1,000,000, 70% of it is attributed as the structure value.

However, a cost segregation study reveals that out of the $710,000 total structure value and cost of furniture (70% of $1,000,000 + $10,000 in furniture), 30% of the components depreciate to $0 within 15 years.

This means that you can apply accelerated depreciation schedules to $213,000 ($710,000 x 30%) of your components. With 100% bonus depreciation back in the picture, you can claim the full $213,000 as tax deductions within 1 year, instead of spreading over 5, 7, or 15 years.

This is also in addition to the $490,000 ($700,000 - $210,000) left in main building structure value depreciated over 39 years, where you can claim about $12,564 in standard depreciation deductions for year 1 and succeeding years.

This brings your total deductions from depreciations alone up to $225,564 in year 1.

Instead of doing all of these calculations, you can also use our built-in bonus depreciation calculator, found in the bottom of your property analysis. This makes it much easier to picture your potential deductions before you even pull the trigger.

Here’s a sample calculation for the scenario we’ve mentioned above.

Wrapping Things Up

If you’re serious about maximizing your tax deductions, especially with the return of 100% bonus depreciation, then finding out how to best depreciate your structure value is non-negotiable. If you can accurately identify the components of your structure value, you can unlock the full benefits of depreciation. By doing so, you position yourself to take advantage of accelerated and bonus deductions, reduce your taxable income, and boost your cash flow from day one.

⚡️

Entdecken Sie die Airbnb- und Langzeitvermietungs-Rentabilität jeder Immobilie

Diese Immobilie kaufen und auf Airbnb anbieten.