Airbnb Calculator

Reveal your property's rental profitability

Buy this property and list it on Airbnb.

See rental comps, return metrics, setup costs, and more

Investors

Take the guesswork out of your investment

Get fully informed

Eliminate financial guesswork in Airbnb investing with BNB Calc. Just enter an address and receive:

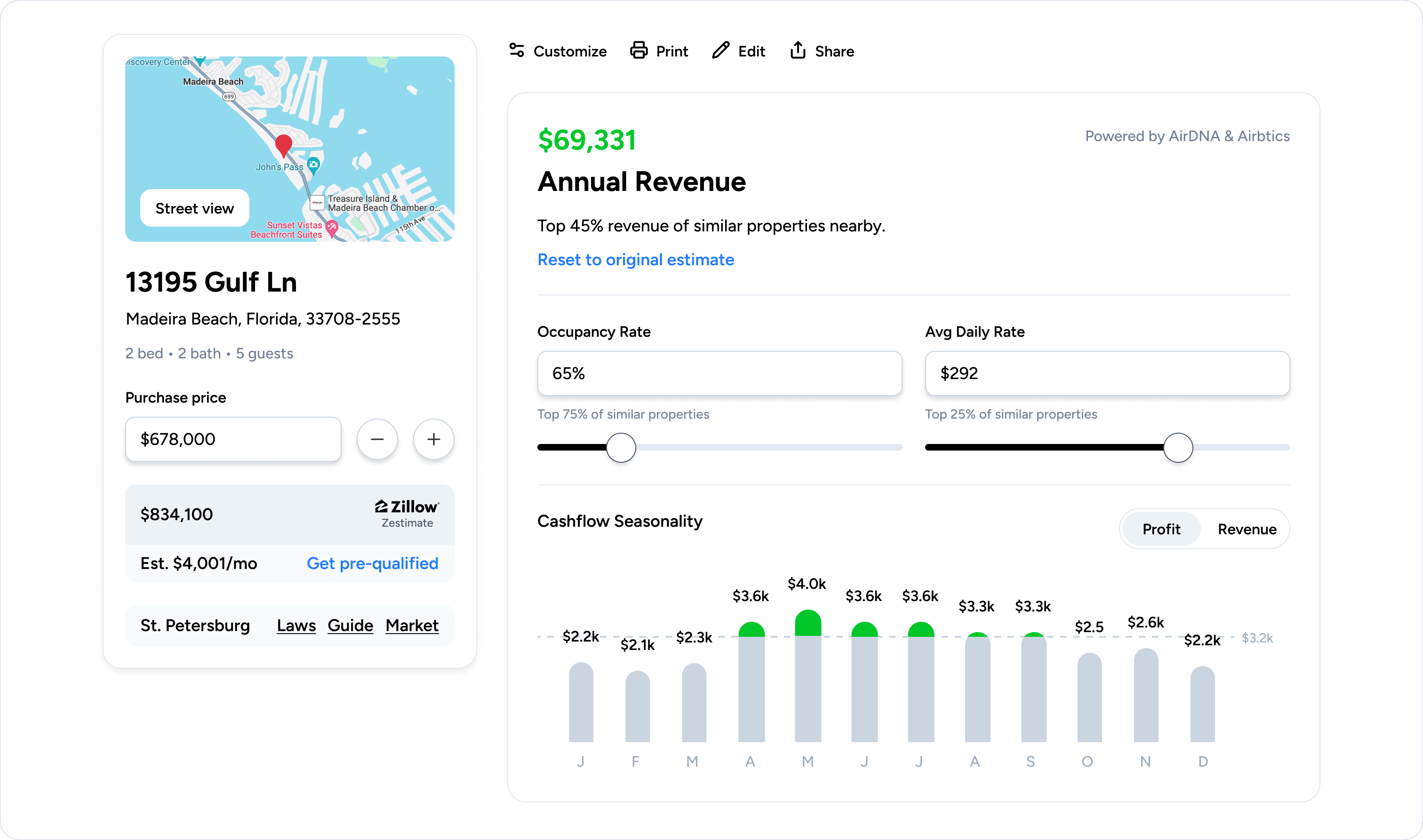

- Instant revenue projections from Airbnb and Vrbo

- 40 short term and long term comps with revenues

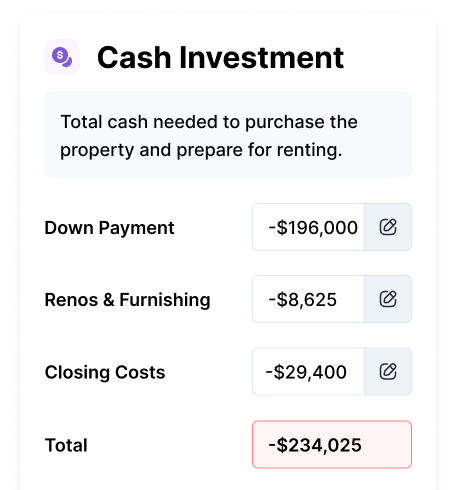

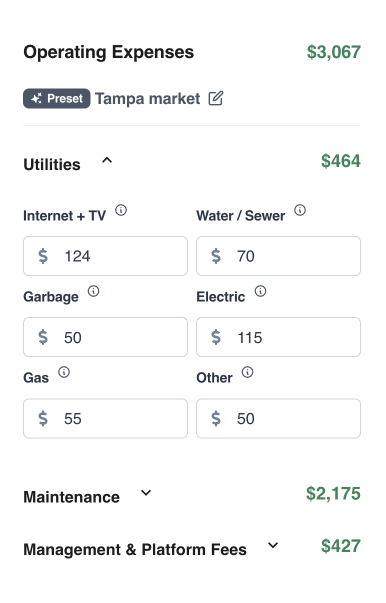

- Financial summary with expenses and financing

- Estimated tax deductions

- Share link and printout

- Import links from Zillow or MLS

Compare to other rentals in the area

See how your property stacks up against other short term rentals that have been operating in the area already.

Detailed breakdown of upfront costs

Detailed breakdown of upfront costs

Maximize Your Rental Property Tax Deduction

Trump's 2025 tax bill extends 100% bonus depreciation for Airbnb properties, creating massive tax savings opportunities. This STR tax loophole allows you to deduct the full cost of qualifying assets in year one, dramatically reducing your taxable income.

100% Bonus Depreciation Schedule Analysis

Standard vs Accelerated Depreciation Comparison

Section 179 Airbnb Tax Benefits Calculator

Overall Tax Savings Projections

Adjustable Tax Assumptions & Scenarios

Cost Segregation Strategy Recommendations

Real estate agents

Help your clients and grow your business

Offer expert guidance

Give your clients confidence in the numbers before making an offer. Be the go-to source for answers.

Collect lead flow every time you share

See how your property stacks up against other short term rentals that have been operating in the area already.

Automated social media content

Share beautiful posts on your social media pages along with your share links that generate leads for your business.

Testimonials

Trusted by the best

Over 6,000 investors, property managers, cohosts, and realtors are growing their business with BNB Calc

Analyze your first property

No credit card required

Street Address *

Address line 2 (optional)

Purchase Price *

Avg 3 per bedroom